The Canary Islands

Welcome to

The Canary Islands!

Seven unique islands offering diverse locations;

rainforest, desert, lakes, alpine mountains, volcanoes,

cities, villages, dramatic roads, beaches, villas, pools

and much, much more!

(13 in summer).

Tax Incentives in The Canary Islands

At a very generous 50%, The Canary Islands offer the international film producer one of the highest tax incentives in the world, making the islands an even more attractive location for your next movie.

Basic requirements:

· One million euros spent in the Canary Islands

· Minimum production budget of 2 million euros

· Contracting a film producer registered with the Institute of Cinematography and Audiovisual Arts, (ICCA), who has his/her tax residence in the Canary Islands.

· For Animation and Postproduction the mininum spent in the Canaries is 200.000€

Canary Islands Tax Incentives

At a very generous 50%, The Canary Islands offer the international film producer one of the highest tax incentives in the world, making the islands an even more attractive location for your next movie.

At a very generous 50%, The Canary Islands offer the international film producer one of the highest tax incentives in the world, making the islands an even more attractive location for your next movie.

Basic requirements:

· Minimum one million euros spent in the Canary Islands

· Minimum production budget of 2 million euros

· Contracting a film producer registered with the Institute of Cinematography and Audiovisual Arts, (ICCA), who has his/her tax residence in the Canary Islands.

· For Animation and Postproduction the mininum spent in the Canaries is 200.000€

How does it work?

This scheme is open to foreign productions and includes feature films, documentaries, drama series and animation films.

To take advantage of the tax breaks in the Canary Islands, you would need to employ the services of a Spanish production company, with tax domicile in the Canary Islands and registered with the Instituto de la cinematografía y de las artes audiovisuales (ICAA). FilmCanaryIslands S.L. meets all these prerequisites, and has more than 10 years production experience in the Canary Islands.

The minimum amount that a producer must invest is set at 1 million euros, and the maximum amount of tax that can be returned is capped at 10 million euros, giving a maximum base limit of 22,111,111.11 euros.

Eligible expenditure is considered to be:

* Expenses in the Canary Islands directly related to the production.

* Expenditure on creative staff provided that their tax residence is in Spain or in a European Economic Area Member State (capped at 100,000€ per person).

* Expenditure on technical industries and other suppliers.

The final amount of tax, (50% on first million, 45% subsequent, of eligible expenditure) is deducted from the corporate income tax of the appointed local production company at the end of the tax period in which the production service is completed.

Once the scheme has been approved for a production, the letters of guarantee should be enough to raise capital in advance from a financial institution, if needed.

If you would like to read more please download the official brochure.

Please contact us for more information on how we can help you access these tax breaks.

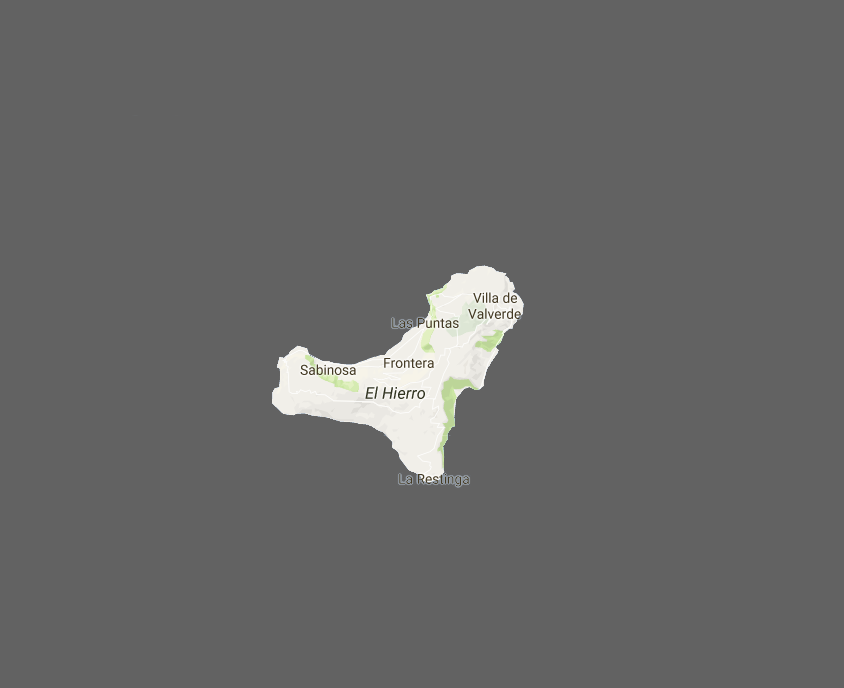

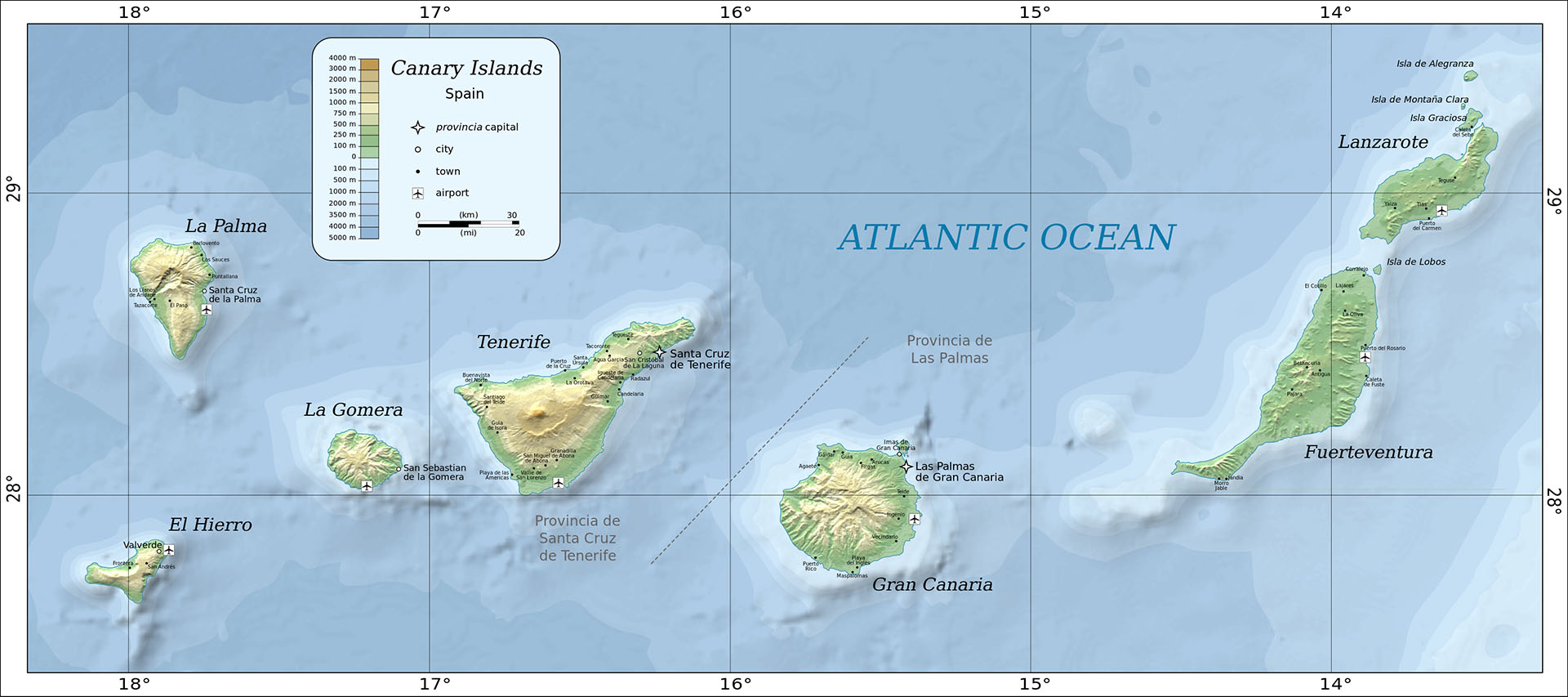

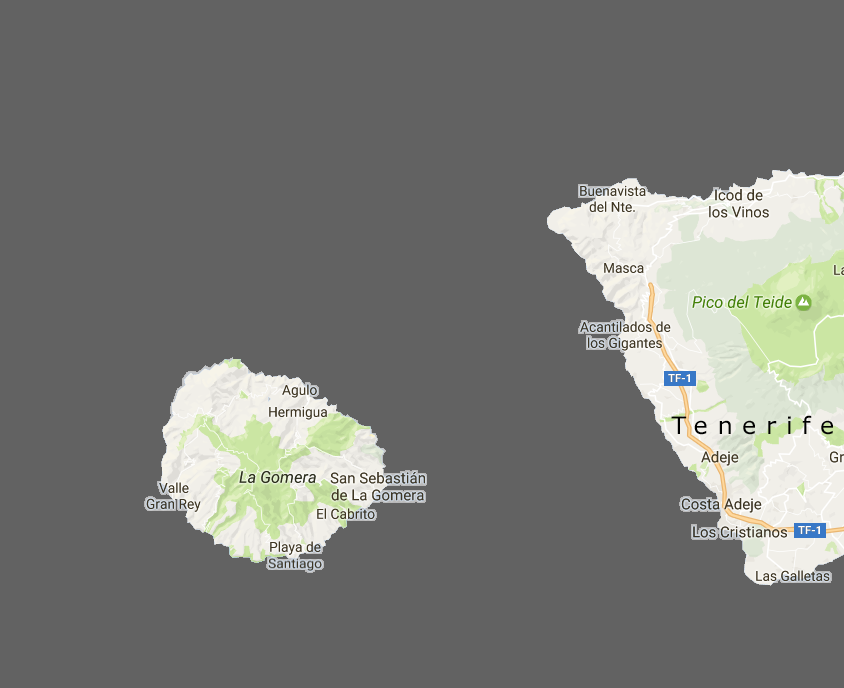

The Canary Islands

The Canary Islands - General Information

Total Area: 7 main islands covering 7,447 km²

Population Total (2009): 2,098,593

Ethnic Groups: 71% Canarian, 12.5% Spanish, 16.5% foreign (European, African, Latin American)

Population Density: 281/km²

Currency: Euro

Voltage: 220v, standard European plugs.

Fuerteventura

Capital: Puerto del Rosario

Area: 1,660 km²

Población: 100,929

Aeropuertos: Fuerteventura (FUE - Internacional y vuelos internos) 5 kilómetros desde Puerto del Rosario.

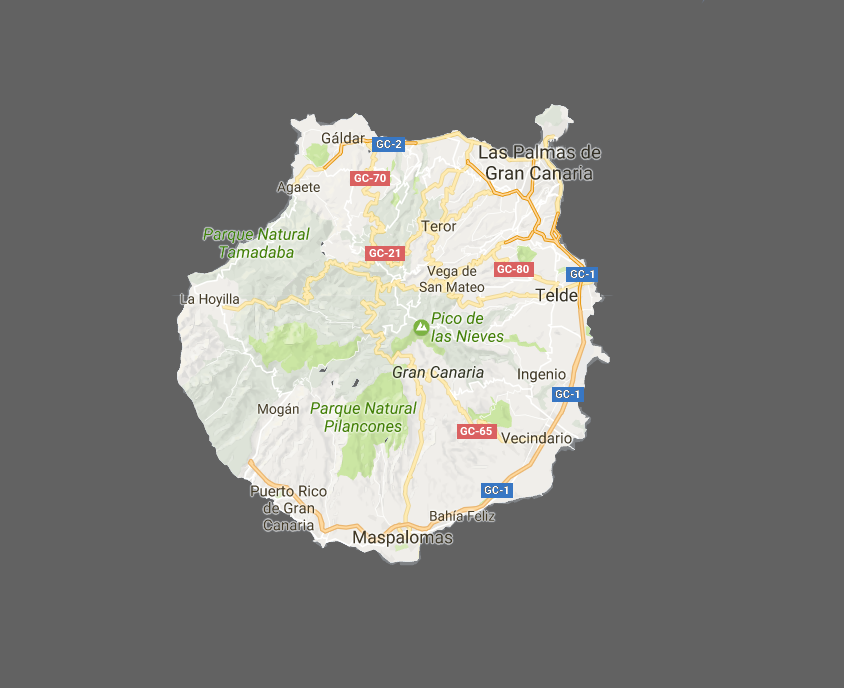

Gran Canaria

Capital: Las Palmas de Gran Canaria

Capital: Las Palmas de Gran Canaria

Area: 1,560 km²

Population: 829,597

Airports: 1: Las Palmas (LPA - international and internal) 19km from Las Palmas.

Capital: Arrecife

Capital: Arrecife Capital: Santa Cruz de La Palma

Capital: Santa Cruz de La Palma Capital: San Sebastian

Capital: San Sebastian